Health Savings Account (HSA) IRS limits

2024 |

||

|---|---|---|

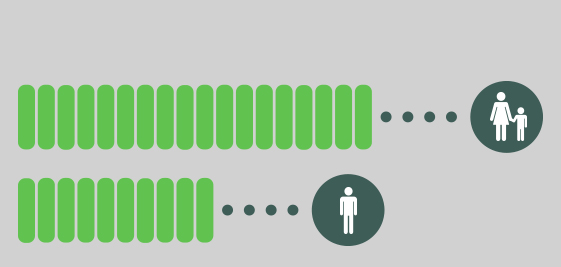

| Single Plan | Family Plan | |

| Maximum Contribution Limit | 4150 | 8300 |

| Minimum Deductible | 1600 | 3200 |

| Maximum Out-of-Pocket | 8050 | 16100 |

| Catch-up Contribution (55+) | 1000 | 1000 |

2025 |

||

|---|---|---|

| Single Plan | Family Plan | |

| Maximum Contribution Limit | 4300 | 8550 |

| Minimum Deductible | 1650 | 3300 |

| Maximum Out-of-Pocket | 8300 | 16600 |

| Catch-up Contribution (55+) | 1000 | 1000 |

Flexible Spending Account (HC-FSA and LP-FSA) IRS limits

2023 |

||

|---|---|---|

| Maximum Contribution | $3,050 | |

| Maximum Carryover Amount | $610 | |

2024 |

||

|---|---|---|

| Maximum Contribution | $3,200 | |

| Maximum Carryover Amount | $640 | |

Dependent Care Flexible Spending Account (DC-FSA) IRS limits

2023 |

||

|---|---|---|

| Maximum Contribution | $2,500 | |

| If Filing Taxes Jointly, Maximum Contribution | $5,000 | |

2024 |

||

|---|---|---|

| Maximum Contribution | $2,500 | |

| If Filing Taxes Jointly, Maximum Contribution | $5,000 | |

Commuter Benefits - Parking and Transit IRS limits

2023 |

||

|---|---|---|

| Maximum Contribution (Per Month / Per Each Benefit) | $300 | |

2024 |

||

|---|---|---|

| Maximum Contribution (Per Month / Per Each Benefit) | $315 | |

Tuition Reimbursement Account IRS limits

2023 |

||

|---|---|---|

| Maximum Contribution | $5,250 | |

2024 |

||

|---|---|---|

| Maximum Contribution | $5,250 | |

Adoption Assistance IRS limits

2023 |

||

|---|---|---|

| Maximum Contribution | $15,950 | |

2024 |

||

|---|---|---|

| Maximum Contribution | $16,810 | |

IRS-qualified medical expenses

You can pay for a wide range of IRS-qualified medical expenses with your HSA, including many that aren't typically covered by health insurance plans. This includes deductibles, co-insurance, prescriptions, dental and vision care, and more. For a complete list of IRS-qualified medical expenses visit IRS.gov or view a list of qualifying examples.